The global fintech has announced new product features and a partnership with Lemonway to help marketplaces accelerate growth beyond borders.

San Francisco – June 4, 2024 – Nium, the global leader in real-time cross-border payments, today announced the expansion of its platform to serve the multi-trillion-dollar global marketplace opportunity. The new product functionalities are available on Nium’s existing global payments platform, enabling marketplaces to incorporate a suite of features that streamline payouts to their cross-border sellers operating in multiple countries around the world, including:

- Flexible multi-currency payouts – Pay international sellers in over 220+ markets, 100+ currencies, and 100+ real-time corridors to bank accounts, cards, and wallets

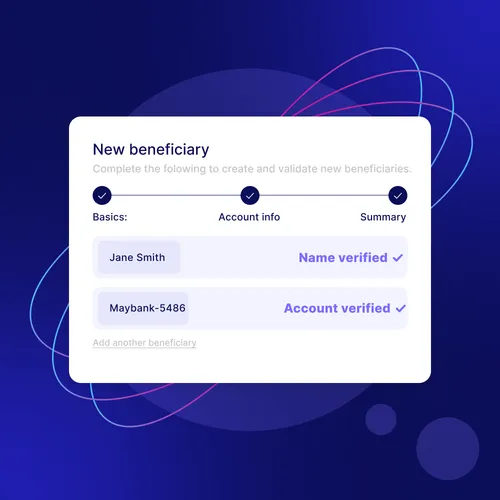

- Fast and simple onboarding – Instantly verify payout accounts and leverage automated ID verification Know Your Customer and Business capabilities for fast and efficient seller onboarding

- Taxpayer information reporting – Collect taxpayer information to fulfill tax calculations and reporting obligations

- End-to-end white labelling – Build tailored payout journeys in a fully white-labeled environment, gaining full control over the seller ecosystem to remain competitive and improve seller retention

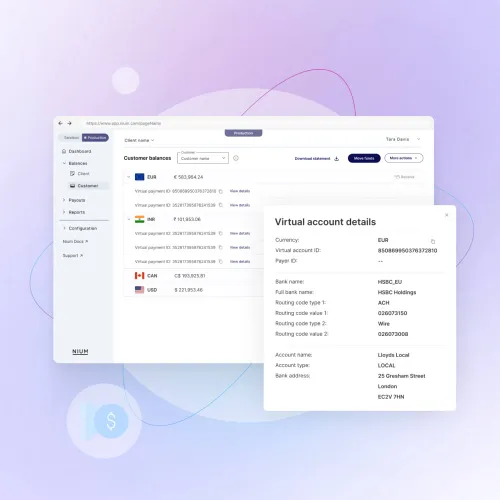

- Collect, convert, and disburse – Collect settlement funds locally in 25+ markets in a multi-currency wallet and split the funds across wallets such as fee commission and seller wallets

- Simple FX management – Lock and hold foreign exchange (FX) rates for longer to better manage currency risks and control transaction costs

- Global licensing – Access Nium’s growing network of licenses in over 15+ jurisdictions worldwide for comprehensive global coverage and regulatory compliance

For marketplaces with cross-border sellers, navigating the local complexities of different compliance regimes, payment preferences, and FX fees at scale has historically made seller payouts challenging. Different regions also bring their own unique economic context, which may dictate seller payment schedules, methods, cost and speed. Time and money spent adapting to these local dynamics is effectively time to market for new regions, slowing down global growth.

“With 33% of the $8.8 trillion global ecommerce market predicted to be cross-border by 2028, real-time cross-border payouts have the potential to drive marketplace seller acquisition and international revenue opportunities. For too long, marketplaces have had to retrofit their unique payment needs into existing solutions with limited payout functionality and reach, stunting growth and seller relationships. We’re extending our platform to address this problem, meeting the needs of global marketplaces so they can build more flexible, dynamic, and efficient payment ecosystems whilst maintaining collaborative relationships with their sellers around the world,” said Ramana Satyavarapu, Chief Technology Officer at Nium.

Lemonway and Nium join forces to help marketplaces accelerate growth beyond borders

Lemonway, one of Europe’s leading payment service providers (PSP) with over 400 marketplace customers, has partnered with Nium to add payouts via SEPA Instant rails to its existing solution, enabling online marketplaces to meet the needs of more cross-border sellers and accelerate growth. So far, Lemonway has processed almost $1 billion in payment volumes on behalf of its customers via the Nium platform.

“For marketplaces, the ability to seamlessly acquire sellers operating in multiple markets – and offer them all a consistent payment experience – cannot be understated. Nium is helping us to deliver just that for our marketplace customers across Europe. Together, we are empowering these platforms to redefine the seller payment experience, tap into a thriving global community, and accelerate new market expansion,” said Jérémy Ricordeau, Chief Operating Officer at Lemonway.

In a rapidly expanding global ecommerce market, the loyalty of sellers is not a given. A 2023 report found that 56% of businesses sell on more than two online marketplaces compared to 50% a year prior while 62% of sellers surveyed plan to sell on more marketplaces in the next 12 months. “If marketplaces are to expand their market share, acquiring, retaining and growing sellers operating globally will require a new approach to cross-border payouts,” adds Nium’s Ramana Satyavarapu. To find out more about what sellers want from marketplace platforms, and how to turn global seller payouts into a growth engine, download Nium’s latest e-book.

This is a strategic move for the payments fintech unicorn as it continues an impressive growth trajectory, in part driven by new product innovation and vertical expansion. Today, Nium serves some of the world’s largest financial institutions, digital platforms, and global businesses across the remittance, payroll, spend management, travel, insurance, and marketplace sectors.

.png@webp)