Verifying your Business in Hong Kong

This article outlines the documents required for organizations registered in Hong Kong to complete business verification.

Verification, commonly referred to as KYC or "Know Your Customer," is a regulatory requirement for offering financial services to businesses and individuals. The process involves collecting, reviewing, and maintaining information about the entities and individuals using our services.

The verification process is divided into two primary components: Business Verification (Verifying the nature and ownership of the business) and Individual Verification.

Topics covered here, include:

- Verifying the nature of your business

- Verifying ownership

- Verifying individuals

- Additional requirements

- Document requirements

Verifying the Nature of your business

The Nature of your business must be verified to ensure it aligns with regulatory requirements, accurately reflects its stated operations, and complies with industry and legal standards. Evidence of business activities may include:

- Website

If your company does not have a working website, please provide one of the below:

- Contracts

- Business agreements

Or, a combination of the following:

- Company profile or presentation / company brochures or marketing material / detailed business plan

- Invoice (document must be issued within 1 year, and must clearly showcase business operations)

Prohibited Business Categories

If company’s industry falls under any one of the listed categories, the application may be either rejected, or additional documents may be requested.

Prohibited and Restricted Business Categories

Verifying Ownership

Documents that may be required for different company types:

| Entity Type | Required Document 1 | Required Document 2 | Required Document 3 |

| Private Limited |

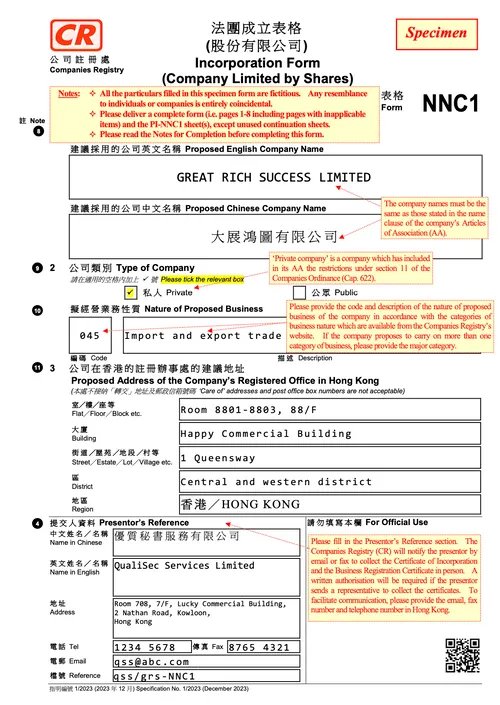

NNC1 - if company is registered within 1 year) NNC1 - if company is registered within 1 year) NAR1 document - if company is registered more than 1 year ago |

HK Business registration document | HK Certificate of Incorporation |

| Partnership | Partnership agreement | HK Certificate of incorporation | HK Business registration document |

| Sole Proprietor | HK Business registration document | - | - |

See requirements for documents here

For Multi-layer ownership structure companies, see section Multi-layer ownership structure

Verifying Individuals

Depending on the company type, the individuals below must be verified:

| Entity Type | Applicant | One of the Directors | Ultimate Beneficial Owners / Controlling Persons | Additional authorized signatories | All Partners | Sole Owner |

| Private Limited | ✓ |

✓ *Under some conditions, verification of all Directors may be required |

✓ | ✓ | ||

| Partnership | ✓ | ✓ | ✓ | |||

| Sole Proprietor | ✓ | ✓ | ✓ |

See requirements for documents here

Additional requirements

- Letter of Authorization

- Multi-layer ownership structure

- Ultimate Beneficial Owner declaration

- Controlling Person declaration

- Source of Funds / Source of Wealth

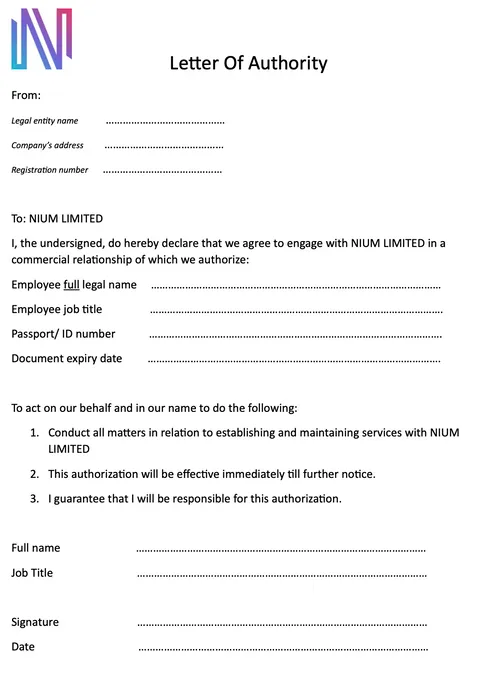

Letter of Authorization

Download Letter of Authorization here

If the onboarding application is being prepared or submitted by individuals who are not Directors, a Letter of Authorization is required. This form authorizes these individuals to act on behalf of the company. Below are the requirements based on the company type:

| Entity Type | When Required | Who Signs the Document | Document Validity |

| Private Limited | For any individual who is not a Director | Company Director | Must be dated within 1 year |

| Partnership | For any individual who is not a Partner | Company Partner | Must be dated within 1 year |

| Sole Proprietor | For any individual who is not the Sole Owner | Company Sole Owner | Must be dated within 1 year |

Multi-layer Ownership Structure

A multi-layer ownership structure exists when a company is owned indirectly through one or more intermediate entities, rather than being directly owned by individuals or a single organization.

To determine if your company has a multi-layer ownership structure, please refer to the below questions:

- Is your company owned by another entity (e.g., a company, trust, or partnership) rather than directly by individuals?

If yes, there is at least one layer of ownership. - Does that owning entity itself have owners who are other entities?

If yes, this adds another layer to the structure. - Can the ultimate beneficial owners (the individuals who control or benefit from the company) only be identified by tracing ownership through multiple entities?

If yes, your company has a multi-layer ownership structure.

In simpler terms, if you must navigate through several entities to find the ultimate owners or decision-makers, your company likely has a multi-layer ownership structure.

Providing documents for multi-layer ownership structure

Providing documents for multiple layers of ownership ensures transparency and helps verify the identities of all individuals who ultimately control the company. Nium may request to submit the documents for all layers of the company ownership.

If the holding companies are incorporated in Hong Kong, the same requirements will apply as listed in section Verifying ownership.

For non-Hong Kong incorporated entities, required documents may include:

- Business registration document / Certificate of Incorporation.

- Register list of Directors and Register list of shareholders (can be same document as number 1 if it holds the same information).

See requirements for documents here

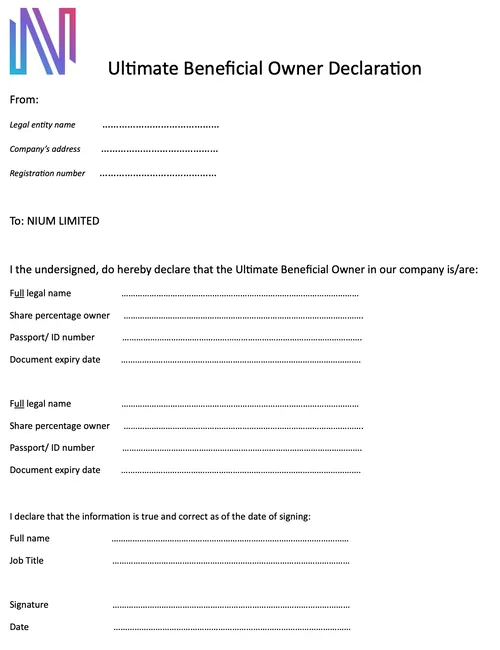

Ultimate Beneficial Owner Declaration

Depending on the company structure, Ultimate Beneficial Owner declaration may be requested, but is not applicable to all onboarding cases.

When Nium cannot identify an individual holding 25% of ownership shares, directly or indirectly, UBO declaration will be requested.

Download Ultimate Beneficial Owner declaration here

Declaration must be signed by company Director, and the Director must be listed in NNC1 /NAR1 document.

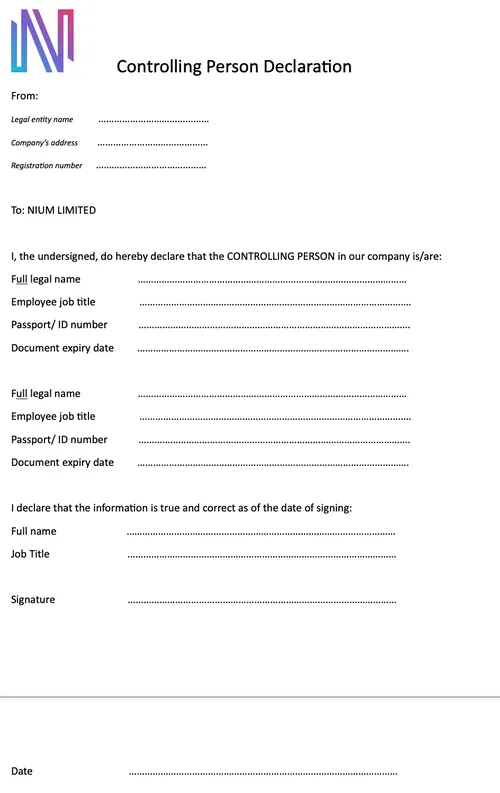

Controlling Person Declaration

Depending on the company structure, Controlling Person declaration may be requested, but is not applicable to all onboarding cases.

When there is no single individual holding 25% of ownership shares, directly or indirectly, Controlling Person declaration will be requested.

Download Controlling Person Declaration here

Declaration must be signed by company Director, and the Director must be listed in NNC1 / NAR1 document.

Source of Funds / Source of Wealth

Nium may request a Source of Funds or Source of Wealth document under certain circumstances. This is not a requirement for all customers and is only requested in specific cases. Factors such as the type of business, the nature or industry of business activities, and any elements affecting Nium’s risk assessment may lead to an Enhanced Due Diligence Questionnaire being issued. Please note, this is not applicable to all onboarding cases and is determined on a case-by-case basis.

Source of Funds - the origin of funds that an individual or company uses to finance its operations.

Source of Wealth – origin and means of wealth, reflecting the overall accumulated net worth of entity/individual, used to establish and operate a company. A written explanation, accompanied by supporting documentation, must be collected to confirm the legitimacy of the customer’s wealth for conducting business.

Examples of supporting documentation for Source of Wealth / Source of Funds:

- Personal or joint savings, collected in form of bank statements

- Employment income, including salaries, bonuses, and pension

- Loan agreements

- Contract agreements

- Sale of assets (real estate, shares)

- Inheritances, including family wealth transfer

- Compensation from legal settlements

- Profits from legitimate business activities or investments

- Ownership of businesses or investments, including returns

- Other documents, related to customer’s funds or wealth

Document Requirements

Identity and Address Verification

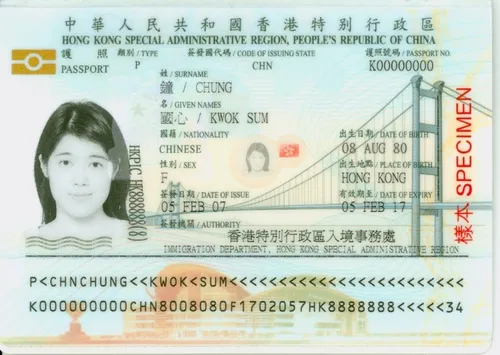

Proof of Identity

- Passport

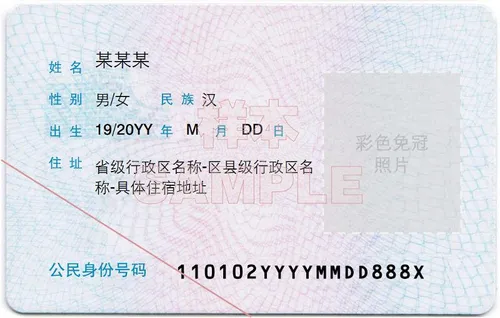

- National ID card (both sides). For HKIC (HKID) only front side is sufficient

- Document should be with valid expiry date, good quality, colored copy, all four corners must be visible.

- Copy of a copy is not accepted.

- Black & white documents are not accepted

Examples of identity documents

Passport

HKIC (HKID)

For Chinese citizens, Chinese Resident Identity Card is acceptable, and both front and back sides are needed.

Proof of Address

- Utility bill

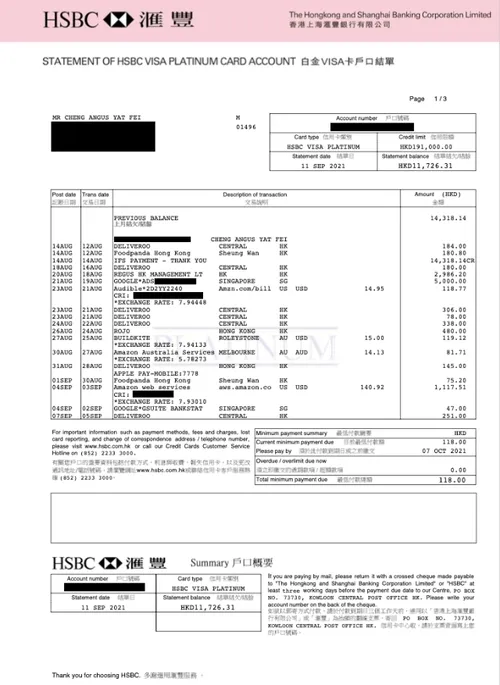

- Bank statement

- Rental agreement

- Government issued letter

- Phone bill (landline only)

- Document must be dated within 90 days

- Cropped documents are not accepted

- Invoices are not accepted

- PO BOX and CMRA addresses are not accepted

Examples of address documents

Bank statement

Ownership document requirements

Ownership document requirements for Hong Kong incorporated entities:

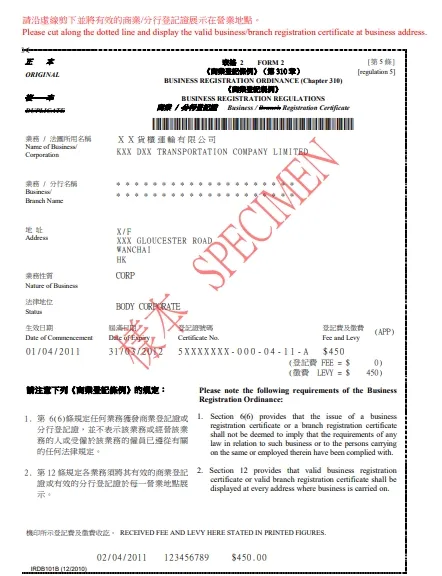

HK Business registration document must be:

- Issued within 1 year

Example of HK Business registration document

Example of HK Certificate of Incorporation document

Example of NNC1 document from Hong Kong Companies Registry

Download NNC1 document from Hong Kong Companies Registry here

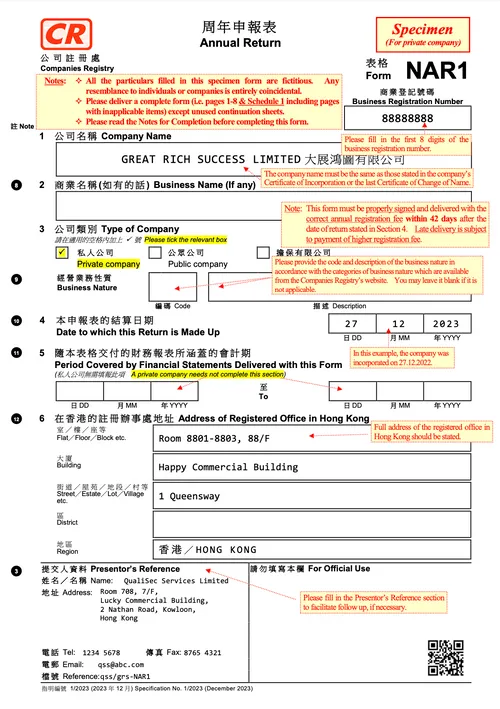

Example of NAR1 document from Hong Kong Companies Registry

Download NAR1 document from Hong Kong Companies Registry here

Ownership document requirements for non-Hong Kong incorporated entities:

Business registration document / Certificate of Incorporation. Document must include:

- Business name

- Business registration number

- Issuing authority

- Registration date

- Company address

- Issuing country

Register list of Directors and Register list of shareholders. Document must include:

- Business name

- Business registration number

- List of company Directors

- List of company Shareholders, and their holding percentages

- Document must be issued within 6 months

- Document must be dated

- Document must be signed by company Director/UBO