Money Movement for Modern Banks

Enable real-time payments, enhance transparency, and optimize operational efficiency through our global network.

Banks

Real-Time Infrastructure for Global Business

Delivering cost-effective, reliable payment services, while optimizing cross-border reach, treasury management and differentiating service offerings, has become table stakes for banks.

Nium provides banks with robust, real-time payments infrastructure with seamless API integration, comprehensive compliance monitoring on a global scale. Reduce costs, increase speed, and deliver unparalleled transparency, ready to adapt to whatever the market brings.

On-Demand Payments Anywhere

-

Access a global payment network

Send payments to over 190 countries, including 100+ real-time destinations with compliance built-in as standard.

-

Tailor payouts to customer needs

Offer flexible and customer-centric payment solutions, including payouts to bank accounts, wallets, and cards, or through local and foreign currency wires.

-

Reach every customer

Support B2B, B2C, P2P payments on behalf of your customers with a single, integrated solution that caters to multiple transaction types.

End-to-End Transparency

and Reliability

-

Track payments precisely

Drill down into payment journeys with Nium’s Chronometer tool for

real-time updates on payment statuses and estimated delivery for complete transparency, or track your wires with SWIFT’s UETR. -

Eliminate unnecessary fees

Ensure recipients receive the full payment amount without deductions, leveraging local payment rails for cost-effective transactions.

-

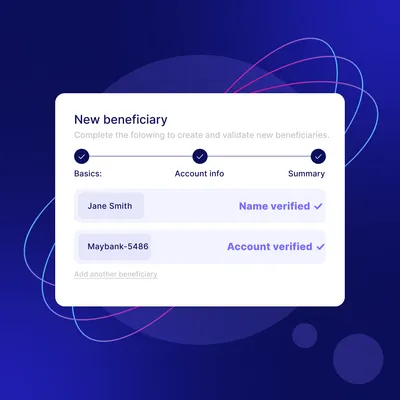

Pre-validate beneficiary accounts

Minimize payment errors and returns, friction and delays by pre-validating beneficiary details upfront for complete predictability.

Streamlined Market Entry

-

Accelerate payment transmission

with simple integrationsInitiate payments within minutes through Nium Portal without the need for a complex integration, or start exchanging SWIFT MT and ISO20022 messages with simple configurations.

-

Automate reconciliation and reporting

Access detailed reporting, including MT940 account statements, to automate bank reconciliation and improve financial oversight.

-

Expand globally with a single payment partner

Access 100+ real-time destinations and flexible payout methods with a single contract and integration.

The World’s Trusted

Payment Partner

-

Work with a proven leader

Nium processes over $25B in transactions annually, with 80% of payments completed in under 15 minutes, ensuring reliability and efficiency.

-

Minimize risk with global licensing and compliance

Operate with confidence as Nium is regulated in 35+ markets across Asia, Europe, and the Americas. Minimize regulatory risks and enhance security with 360° regulatory compliance, including real-time transaction monitoring and fraud detection and AML/CTF measures.

-

Access best-in-class support

Count on round-the-clock support from payment experts and a

dedicated account manager to ensure seamless operations and swift

issue resolution.

Join 1000+ companies on the Nium payments infrastructure

Our FI customers include:

Products

The Global Infrastructure For Real-Time Payments

Nium moves money, manages foreign exchange and mitigates

fraud risk so your business can send and receive funds in real time.

Resources

Meet Our Team!

Interested?

Ready To Accelerate Your Global Business Growth?

Connect with our experts to explore use cases based on your industry, discuss customized pricing, and answer any questions you have.

220+

Payout Countries and Territories

100+

Real-time markets

100+

Supported currencies

75M

Cards issued worldwide