Today, consumers have end-to-end visibility into the delivery journey of their packages, so why can’t we also track cross-border remittances? With Nium, we can. We provide customers end-to-end tracking of Swift wire transactions from initiation of the payment to remittance to the beneficiary.

If SWIFT wires are core to your flows, come by Money20/20 USA to discuss optimization options.

In order to track money just like tracking packages, we are leveraging the Swift GPI messaging system to extract additional details about the status of a transaction. Global Payment Innovation (GPI) was developed in 2017 to improve the experience of making a payment via the Swift network. Since its inception, the GPI has garnered adoption by over 4000+ banks globally, underscoring its widespread reach.

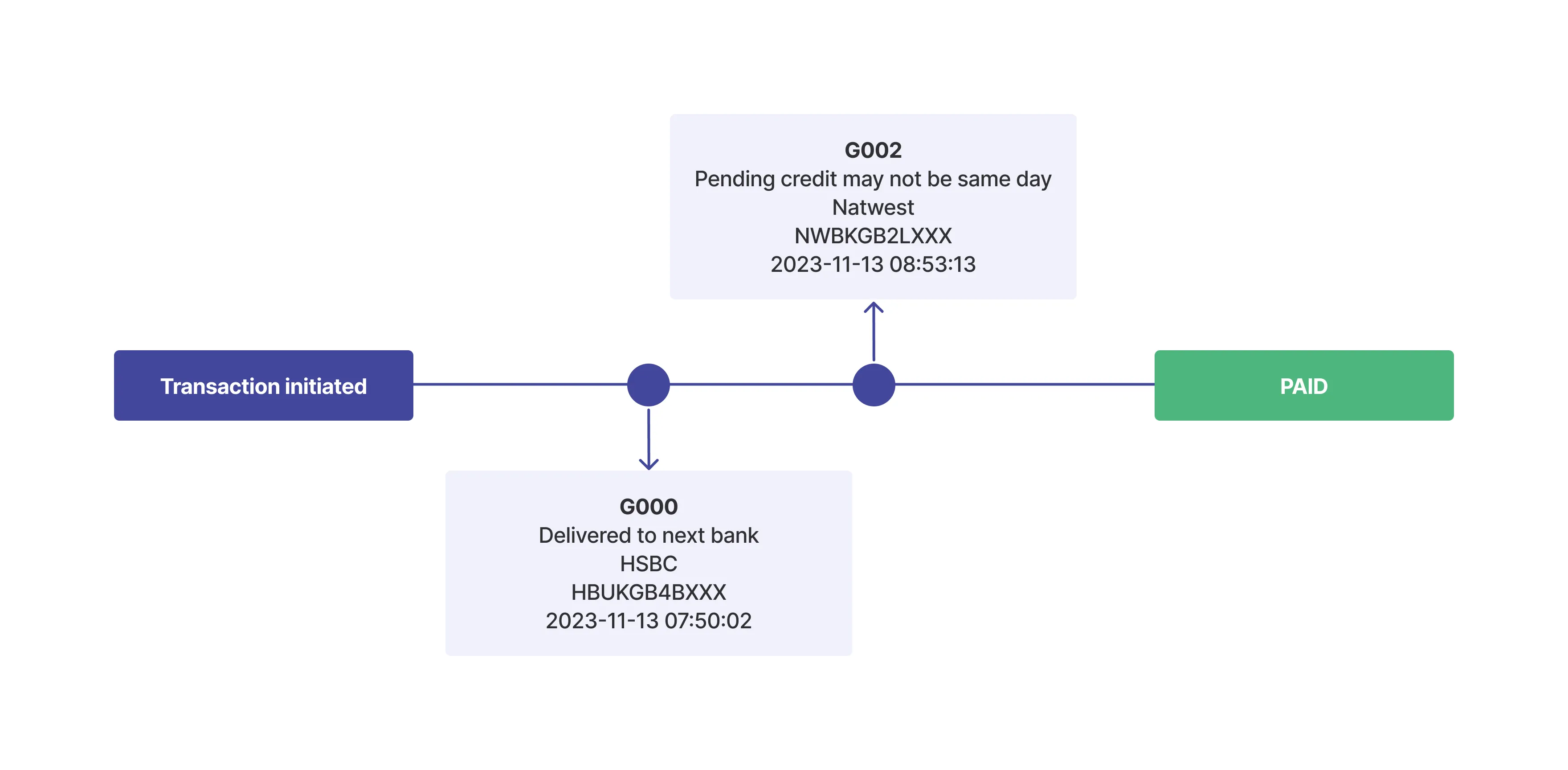

Swift cross border transactions are passed to multiple correspondent banks in order to complete the payment efficiently and effectively. Given the cross-geographical nature of these transactions, the transfer typically spans a duration of a few hours to a few days before reaching the intended beneficiary. Moreover, any delays caused by issues with the downstream correspondent banks can further extend the transaction time. Consequently, both the sender and beneficiary would be interested in transaction tracking to know where the funds are at any particular instance.

There is clear merit with the enhanced tracking of Swift wires through GPI details, but how can this be tailored further to amplify the value? GPI tracking can be used as an effective substitute of MT103 Swift copy that is requested for tracing delayed transactions. As GPI details allow the users to easily track the transfers, this would make an MT103 copy redundant for the transfers that are running late. Moreover, MT103 requires coordination between sender and beneficiary banks which suggests there is always a waiting time (~7 days), effort, and costs (varies bank to bank) associated with such copy.

Our clients can leverage these GPI details to deliver value to their customers by tailoring the offering as per customers' preference. Clients can build a transaction timeline on their portals for the customers who would like to see these updates in UI or can provide these updates through texts or emails for customers preferring messages. This would enhance transparency and visibility that will limit the queries clients receive from their customers about the status of their transactions.

| Parameter | Description | Type |

|

reasonCode |

string |

|

|

statusDescription |

Description corresponding to gpi reason code. This field helps the user to understand the meaning of the field reasonCode. These descriptions are also standarised across all Swift participants. |

string |

|

forwardBankName |

Name of the next participant bank to which the payment has been forwarded. Either this bank will attempt to deliver the payment to the beneficiary or will forward it to next bank in the network. |

string |

|

forwardBankCode |

Bank Code (BIC) helps the user to exactly locate where the money is residing currently. As Swift participant banks have a global presence, BIC informs the user whether the transaction has been forwarded to xxxxxxxx, Bank Singapore or xxxxxxxx, Bank India. |

string |

|

timestamp |

This field informs the user about the date and time of last (latest) gpi update. It can help the user to estimate or anticipate the time for delivery or next status update. |

string |

|

Nium_Status |

gpi (reasonCode) |

gpi (statusDescription) |

Remarks |

|

SENT_TO_BANK |

G000 |

Delivered to next bank |

The payment has been forwarded to the next participant bank in the Swift network. It can be either credited to the beneficiary directly or passed to the next bank. |

|

SENT_TO_BANK |

G001 |

Delivered to next bank (no tracking) |

This often suggests the user may not receive gpi updates beyond this point and will receive a final terminal status. |

|

SENT_TO_BANK |

G002 |

Pending credit may not be same day. |

Often it means that the payment is under manual due diligence in the bank and settlement may take a few hours. |

|

SENT_TO_BANK |

G003 |

Pending receipt of documentation from the beneficiary. |

This often suggests an action on the beneficiary or beneficiary bank. Sender may contact the beneficiary in case of delays or can ensure that the beneficiary details provided are correct. |

|

SENT_TO_BANK |

G004 |

Pending receipt of funds from the previous bank. |

This suggests the forward bank (next Swift network bank) has received an instruction to credit the funds to the beneficiary but it has not received the funds yet. Cover payment is missing but it is expected to arrive soon. The funds are expected to reach the beneficiary upon arrival of cover payment. |

|

SENT_TO_BANK |

G005 |

Delivered to beneficiary bank as GPI. |

This suggests that the payment will be credited soon. |

|

SENT_TO_BANK |

G006 |

Delivered to beneficiary bank as non GPI. |

This suggests that the payment will be credited soon. |

.png@webp)

.png@webp)