SMEs will be able to utilise credit limits from corporate cards through Tat:Bizpay system

SYDNEY, 21 January 2021 – Today Tat Capital launches Tat:BizPay in Australia, their latest working capital solution that allows small and medium-sized enterprises (SMEs) to utilise credit limits in corporate cards to help make payments, including commercial rent, or other supplier payments.

Powered by Nium, Tat:BizPay is a first in Australia.

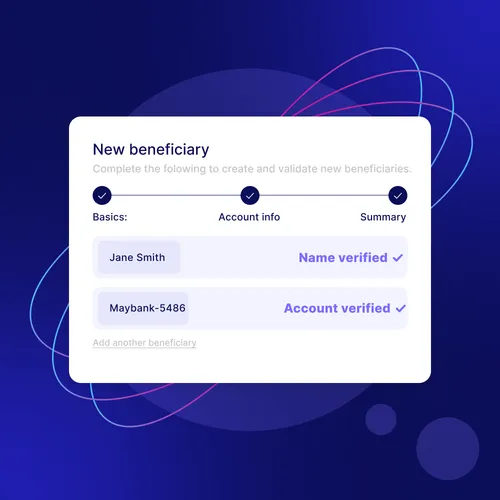

Tat:BizPay allows business owners to convert their credit card limit into an interest-free cash flow stream for their business, for up to 55 days[2]. The platform will allow business owners to use their credit card to pay local vendors that do not accept credit card. Businesses now gain full control of costs, by eliminating fees and charges associated with other credit solution options.

Tat:BizPay provides greater flexibility, ease and speed to the payment of salaries, rent, and suppliers, while saving businesses up to 1.1% on borrowing costs and loan processing fee charges[i] and reducing FX conversion charges for international transfers.

“Tat Capital was created to provide smarter, more equitable paths to wealth,” explains Ram Gorlamandala, Founding Director of Tat Capital, “and Tat:BizPay is a perfect example of this philosophy in action.”

“Innovation in Financial Technology means that we are now able to deliver products and services that are as credible, robust and secure as banks, but free of legacy issues; while being more obtainable, affordable and better suited to the small to mid-sized business sector.

“Daily, due to our networks and relationships here and across the Indian Subcontinent, we are exposed to significant business issues and some very interesting business solutions. And occasionally, we uncover a smart and simple solution that is perfect for local businesses. The Tat:BizPay working capital offering, powered by Nium, is one of these solutions.”

For Michael Minassian, Regional Head of Nium’s Consumer and SME Business (Instarem), the partnership marked the company’s ongoing commitment to expanding fintech solutions that help SMEs improve cashflow. “More than ever, SMEs around the world need access to working capital and credit lines. We are delighted that our collaboration with Tat Capital gives more local businesses a simpler and smarter way to bolster their cashflow.”

Over the coming weeks, the Tat:BizPay solution will be rolled out to all Tat Capital clients who are seeking more efficient working capital options from their credit cards. Once existing clients are fully operational, Tat:BizPay will be available to the wider market – should businesses be interested, they can contact the Tat Capital team for further assistance.

[1] Actual number of days available may vary across card issuing banks

Based on an estimate of the interest cost of borrowing by a small business on overdraft facility to be around 7.3% p.a. (source– https://www.westpac.com.au/business-banking/business-loans/small-business-loans/unsecured-business-overdraft); and an assumption of a credit card providing up to 55 days credit for repayment.

FINANCIAL INSTITUTIONS

Expand and enhance your cross-border offerings with Nium’s real-time global solutions.

.png@webp)