Integration with Nium’s single global API enables Roxe to expand and streamline real-time payouts from the United States to Europe, the UK, Australia and Asia

SINGAPORE AND SAN FRANCISCO, 22 November 2021 – Global B2B payments company Nium and Roxe, the next-generation, open global payment network, today announced a strategic partnership that will allow Roxe to leverage the reach of Nium’s network to pay out to key global markets, including from the US to Europe, the UK, Australia and Asia, in real-time.

Nium holds the broadest licensing portfolio of any independent payments fintech and is the only fintech infrastructure provider to be licenced in more than 40 countries. Today, Nium supports payouts to as many as 190 countries (85 in real time) in 100+ currencies and pay-ins to 35 markets. On the card issuing front, Nium’s reach expands to 33 countries, issuing more than 31 million physical and virtual cards globally. This is all supported by 11 global financial licenses and a robust suite of regulatory and compliance technologies.

“We are delighted to work with like-minded partners such as Roxe, to serve their mission of empowering banks, payment service providers and other connected financial institutions to provide real-time, low-cost payments and payment acceptance to their customers across the world,” said Michael Bermingham, Chief Business Officer and Co-Founder at Nium.

Roxe unifies fragmented global payment systems to provide instant peer-to-peer global payments that do not rely on the correspondent bank model, leveraging the latest advances in blockchain and decentralized liquidity technology to deliver instant settlement on the blockchain, lower foreign exchange costs, and lower cross-border remittance costs.

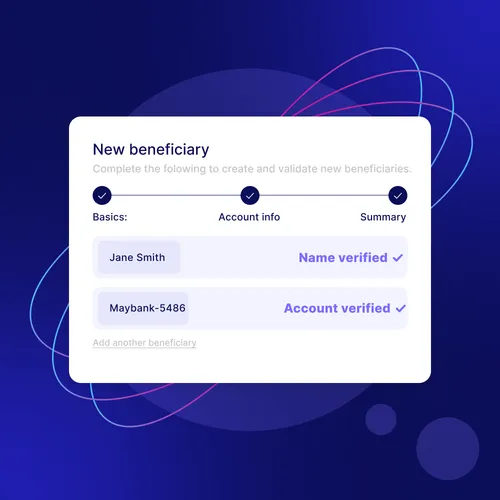

With an unmatched network to deliver global embedded financial services and the capacity to provide integrations in as little as four weeks, Nium provides the speed and scale for customers to unlock new revenue opportunities and improve cash flow economics throughout the global economy.

“Our partnership with Nium enables us to better deliver on our promise of instant peer-to-peer payments that don’t rely on the antiquated correspondent bank model. We pride ourselves on removing barriers so that financial value moves at unprecedented speed at much lower costs anywhere in the world. Partnering with Nium provides us an even more seamless, reliable, and cost-efficient experience for our global customers,” said Thomas Trepanier, Managing Director of Roxe.

Roxe’s integration with Nium’s payout capability will enable Roxe to provide expanded and streamlined real-time payment capabilities from the US to Europe, the UK, Australia and Asia.

***

About Roxe

Roxe is a global payment network that uses blockchain to make money smarter. Roxe’s smart payment technology automatically selects the best route for the fastest, least expensive, and most reliable payments for any business or individual anywhere in the world. The company unifies fragmented global payment systems so that payment and remittance companies, banks, central banks, and consumers can get the speed and cost savings benefits of blockchain technology without directly transacting with cryptocurrencies. Roxe also removes barriers of time, geography, and currency so that financial value moves with unprecedented speed across the globe. Powered by Roxe Chain, a hybrid blockchain purpose-built for payments and other value transfer applications, Roxe also empowers its partners to offer their end customers ultra-fast remittance and payments products. Roxe is designed to be the fundamental component of the global payments industry and is compatible with any traditional and digital financial system. For more information, visit https://www.roxe.io.

About Nium

Nium is a leading embedded fintech company that provides banks, payment providers, and businesses of any size with access to global payment services via one API. Its modular platform powers frictionless commerce, helping businesses pay and get paid across the globe with services for payouts, pay-ins, card issuance, and banking-as-a-service. Once connected to the Nium platform, businesses have the ability to pay out in more than 100 currencies to over 190 countries – 85 of which in real time. Funds can be received in 27 markets, including Southeast Asia, UK, Hong Kong, Singapore, Australia, India, and the US. Nium’s growing card issuance business is already available in 33 countries, including Europe (SEPA), the UK, Australia and Singapore. Nium owns the broadest license portfolio, covering 11 of the world’s jurisdictions, enabling seamless global payments and rapid integration, regardless of geography.

Nium was named to the CB Insights Fintech 250 (2020, 2021), which highlights the most promising Fintech companies globally. For more information, visit: www.nium.com

.png@webp)