The partnership will enable Ruul to provide better collections and payout services to Ruul’s users as they will gain access to Nium’s global payments infrastructure.

LONDON, 12 May 2021 – Next-generation financial services platform Nium and global invoicing and payments platform Ruul announced a strategic partnership that will allow Ruul to leverage Nium’s vast payout network and speedy cross-border collection service.

With approximately 20 million freelancers in the EU, making up 8% of the workforce in the region and nearly 60 million freelancers in the US, which make up about 35% of the workforce[1], the partnership with Nium will enable Ruul to gain competitive advantage in the booming freelance ecosystem and gig economy.

With a simple yet secure financial operations approach, Ruul sets the facilitation of the invoicing and payment processes between businesses and independent professionals at its core. Businesses have become more agile thanks to the swift nature of Ruul’s invoicing and payment system. The collaboration with Nium will make this process even more convenient, secure, and fast.

Nium’s global payments technology stack will not only make the collection and disbursement of funds in local currencies quicker and more cost-efficient for Ruul, but it will also introduce Ruul to new markets, including access to countries such as Taiwan or the Philippines.

With a global network of over 40 partnering banks and a robust regulatory portfolio that includes licences in Singapore, Malaysia, Australia, Hong Kong, India, Indonesia, Japan, the UK, the EU, Canada, and the USA, Nium is also able to provide guidance and support on local policies and regulations in new markets and will enable Ruul to scale globally.

“We’ve been working on our international expansion for a while now. Currently, Ruul offers financial solutions to more than 3,500 businesses engaged in financial transactions with over 35,000 freelancers located in different countries. This partnership will widen our reach, strengthen our operation, and provide financial services to empower businesses who need to make cross-border payments through our innovative platform. We believe that our partnership with Nium will provide just the right support we need to offer the best, most convenient service to our users,” says Mert Bulut, Co-Founder and CEO of Ruul.

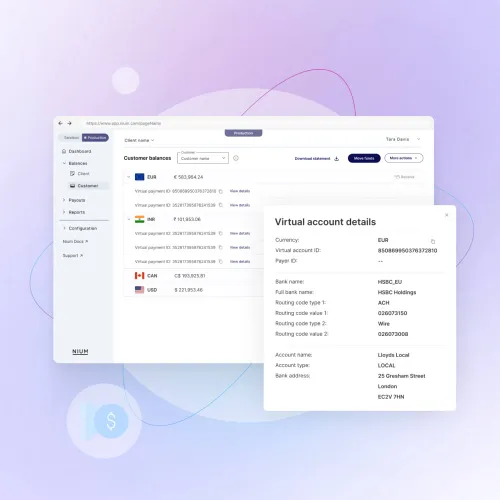

Nium’s pay-out capability allows Ruul to:

- Access to over 65 payment corridors

- Pay freelancers in full in their desired currency (making sure the full amount reaches the payee, with no hidden fees)

- Provide instant, speedy settlements to freelancers

Nium’s pay-in capability allows Ruul to:

- To collect funds from their global corporate partners into dedicated onshore currency accounts in APAC, the EU, the UK & the US

“We are very excited about this partnership and the tremendous opportunities this presents for both parties. We strongly believe in Ruul’s unique business model and want to make sure that every transactional process powered by Nium, will contribute to the overall efficiency and agility of the platform and experience for its users. Our journey together has begun, and we have big plans to unlock even more capabilities and embedded platform APIs to Ruul as we grow this partnership further,” says Danny Carolan May – VP and Head of Business Development in Europe, at Nium.

[1] McKinsey Global Institute – Independent Work: Choice, Necessity and the Gig Economy Report

.png@webp)