Collective network intelligence is used to validate account information before initiating payments, reducing misdirected payments and fraud

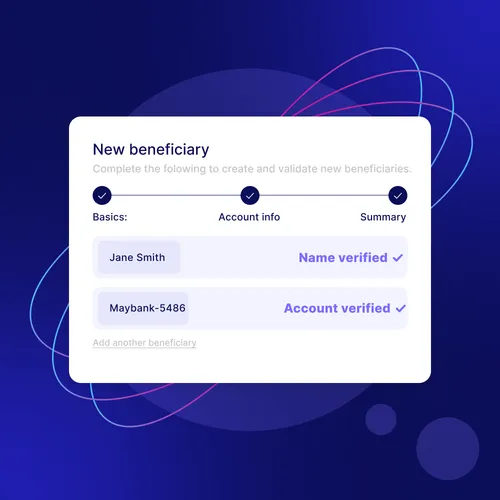

Singapore, 7th November – Nium today announced an expansion to its global collaboration with Kinexys by J.P. Morgan (formerly Onyx by J.P. Morgan), with the cross-border payments leader being the first fintech company to provide data that helps validate bank account details used in international payments to Malaysia, Thailand, and Hong Kong. Nium Verify will provide data to Confirm, an application developed by Kinexys by J.P. Morgan, designed for the exchange of global account validation information. The solution is used to validate beneficiary account details in real-time, prior to payment, significantly reducing the likelihood of errors and failed payments when making cross-border transactions.

Institutions across the globe experience a high number of payment returns and fraud due to the inability to verify account information in real time prior to payment processing. This results in unnecessary fees, payment delays, and customer experience issues. Based on a market evaluation of high-value payment returns in 2020, there is an opportunity to save millions of dollars on high value payments and three to four days of payment-related delays.

Nium is providing data from Nium Verify to Liink, developed by Kinexys by J.P. Morgan’s blockchain business unit, which provides scalable solutions and creates ecosystems that transform the way information, money, and assets move. Liink is the world’s first bank-led, peer-to-peer network that facilitates secure and private information and capability exchange between dozens of sophisticated global institutions, such as banks, credit unions, fintechs and digital banks, among others. Built on a private, permissioned blockchain network, Liink enables participants to share information across its network, all while maintaining the three fundamental properties of information sharing: sovereignty, security and privacy.

“The additional markets for which Nium is able to provide data coverage will expand Confirm’s significant global reach even further, providing incremental value to inquiring participants on the network without requiring any incremental technology uplift," said Zack Chestnut, Global Head of Business Development for Kinexys Liink and Kinexys Digital Payments. “This is in line with Confirm’s goal to provide global account verification services through a single, secure network. We are excited to partner with Nium to provide additional value to our participants and make the global payments ecosystem more efficient.”

Globally, Nium Verify provides real-time insight into the account beneficiaries in more than 50 markets. It applies advanced technologies to indicate in real-time whether account details are accurate. Nium introduced Verify at the Money20/20 conference in Las Vegas.

“We are excited to deepen our relationship with Kinexys by J.P. Morgan and move closer towards our shared goal of providing businesses with faster, more secure, and reliable payment experiences in the rapidly growing APAC region,” said Alex Johnson, Chief Payments Officer at Nium. “This collaboration aligns with Nium’s mission to simplify and streamline cross-border payments for businesses worldwide. By leveraging our account verification capabilities, we are reducing friction in global payments, creating a more efficient, secure, and compliant payments ecosystem."

For more information about Nium Verify, visit the link here.

.png@webp)