SINGAPORE, 19 May 2020 – Global fintech platform Nium announced today the expansion of new remittance corridors for customers of KasikornBank (KBank) through its K PLUS app. The new routes add onto the existing 24 rails currently in developed markets and will include emerging markets in Asia-Pacific.

Announcement on the expansion of remittance routes comes after a year of successful partnership with KBank that saw Nium processing over THB 4 billion worth of remittance volume from developed markets corridors. The new routes will see additions of remittance corridors from markets in Asia-Pacific including Indonesia, Korea, Malaysia, the Philippines, and Vietnam.

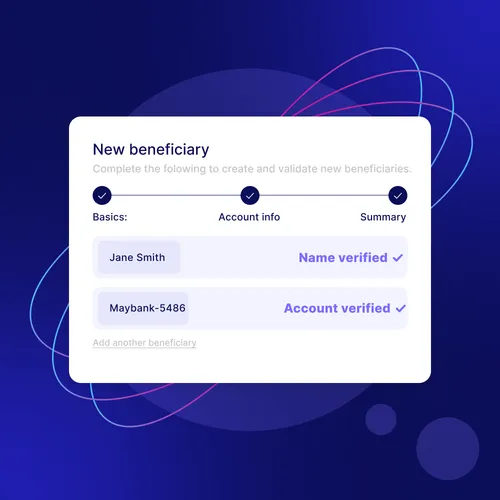

The expansion of digital remittance corridors is part of KBank’s efforts to ramp up their digital cross-border payments offerings to their customers, especially when social distancing measures becomes the new normal. The new routes will be supported by Nium’s real-time payment capabilities, allowing KBank customers access to instant money transfer services when conducting payments in these markets. Real-time payments are also available to KBank customers who are remitting funds to 30 countries across Europe and Asia-Pacific.

“We are happy to announce the expansion of new remittance routes for customers of KBank as it looks to scale its cross-border payments services. Nium looks to create a fintech infrastructure that can help banks and financial institutions launch and scale innovative digital financial services without the complexity, time, and cost previously required to do so, and this continued partnership with KBank to launch more remittance routes overseas with our real-time payments capabilities is a testament of that. We look forward to further working closely with KBank to provide an even better payments experience to their customers,” said Rohit Bammi, Global Head of Institutional Business, Nium.

Silawat Santivisat, Senior Executive Vice President, KBank, further elaborated that the international funds transfer service via K PLUS is a response to the ‘New Normal’ lifestyle amid the prevailing COVID-19 pandemic. “While social distancing is still required, transactions via mobile applications are the perfect option as people can conduct their transactions at home or anywhere else, anytime, without having to head to the nearest bank branch. Apart from the convenient, rapid, simple, and secure features, as well as inexpensive fees, recipients get the full amount of funds with no documents required. Funds transfer can be made in 12 currencies to 30 countries worldwide.”

Nium currently operates its Send, Spend, and Receive business in over 90 countries, 65 in real-time, and in 63 currencies.

About KasikornBank

KASIKORNBANK Public Company Limited was established on June 8, 1945. Throughout the past 70 years, the Bank has always strived to develop our organization and offer financial product initiatives plus excellent service delivery to match our slogan, “Towards Service Excellence”, and the “Customer Centricity” concept. This led to the consolidation of KASIKORNBANK and subsidiaries (K Companies), and the “K KASIKORNTHAI” symbol was adopted to guarantee quality and standards. KASIKORNBANK aims to be an innovative, dynamic, and proactive customer-centric financial institution that creates sustainability for all stakeholders, and to harmoniously combine technology and human resources to create sustainable, world-class financial services, so as to achieve optimal benefits for all stakeholders.

About Nium

Nium is a global financial technology platform redefining the way consumers and businesses send, spend, and receive funds across borders. The company is continuously innovating to provide the most relevant and agile solutions to meet the needs of consumers and businesses, having evolved from solely focusing on consumer remittance via InstaReM, to also providing fintech solutions for businesses from 2019. Nium is regulated in Australia, Canada, European Union, Hong Kong, India, Indonesia, Japan, Malaysia, Singapore, and the United States of America, and processes billions of dollars a year for banks and payments institutions, the next generation of e-commerce players, OTAs and retail users across the world. Nium’s investors include Visa, BRI Ventures, Vertex Ventures, Vertex Growth, Fullerton Financial Holdings, GSR Ventures, Rocket Internet, Global Founders Capital, SBI Japan, FMO (Netherlands Development Finance Company), MDI Ventures, Beacon Venture Capital and Atinum Investment.

FINANCIAL INSTITUTIONS

Expand and enhance your cross-border offerings with Nium’s real-time global solutions.

.png@webp)