Unlocking the potential of real-time payments is a game-changer for businesses operating on a global scale. Traditional payment methods often fall short when it comes to speed and efficiency, causing delays among international partners and employees. However, real-time payments offer a solution by enabling instant fund transfers and providing businesses with a competitive advantage. With the ability to expand into new markets, hire global workers, and establish international supply chains seamlessly, businesses can operate like local enterprises, reducing risk and increasing attractiveness to stakeholders. In this blog, learn the six advantages of real-time cross-border payments:

• Speed. Wire transfers and other payment methods are often ill-equipped to keep international partners and employees satisfied. These transactions pass through an average of six financial institutions (FIs), and wire transfers can take as long as five days to arrive(1).

Even payments that may appear in real-time often aren’t and take hours or even days to settle. Real-time payments arrive in seconds, bringing clarity to cash management and allowing account holders to access funds instantly.

• Competitive advantage. The ability to transfer funds internationally instantly allows businesses to expand into new markets, hire global workers and build international supply chains in an incredibly streamlined way, as businesses can make payments just like they’re a local enterprise.

This not only reduces the risk but makes businesses a far more attractive prospect for partners, customers, and employees.

• Simpler innovation. A modern, open payments system affords the chance to generate and implement innovative overlay services upon real-retime payment rails, built with current open banking standards through API-based services.

• End-to-end communication. In the past, communication typically occurred in a one-way fashion: from the payer to the payee. To exchange information bilaterally, parties had to resort to methods outside the payments system. However, with real-time payments, the payment, and its associated data are combined into a single transaction.

• Cost. Costs for sending funds overseas remain high, with the global average being 6.5% of transaction value, rising to 8.2% in some regions(2). While RTP costs differ from network to network, they often tend to be cheaper than the slower alternatives.

• Liquidity management. Real-time payments can also greatly support a business's liquidity management. By providing businesses with faster access to funds, businesses can better manage cash flow and take advantage of market opportunities. This can be especially beneficial for small and medium-sized businesses, which are often more reliant on cash flow to stay afloat.

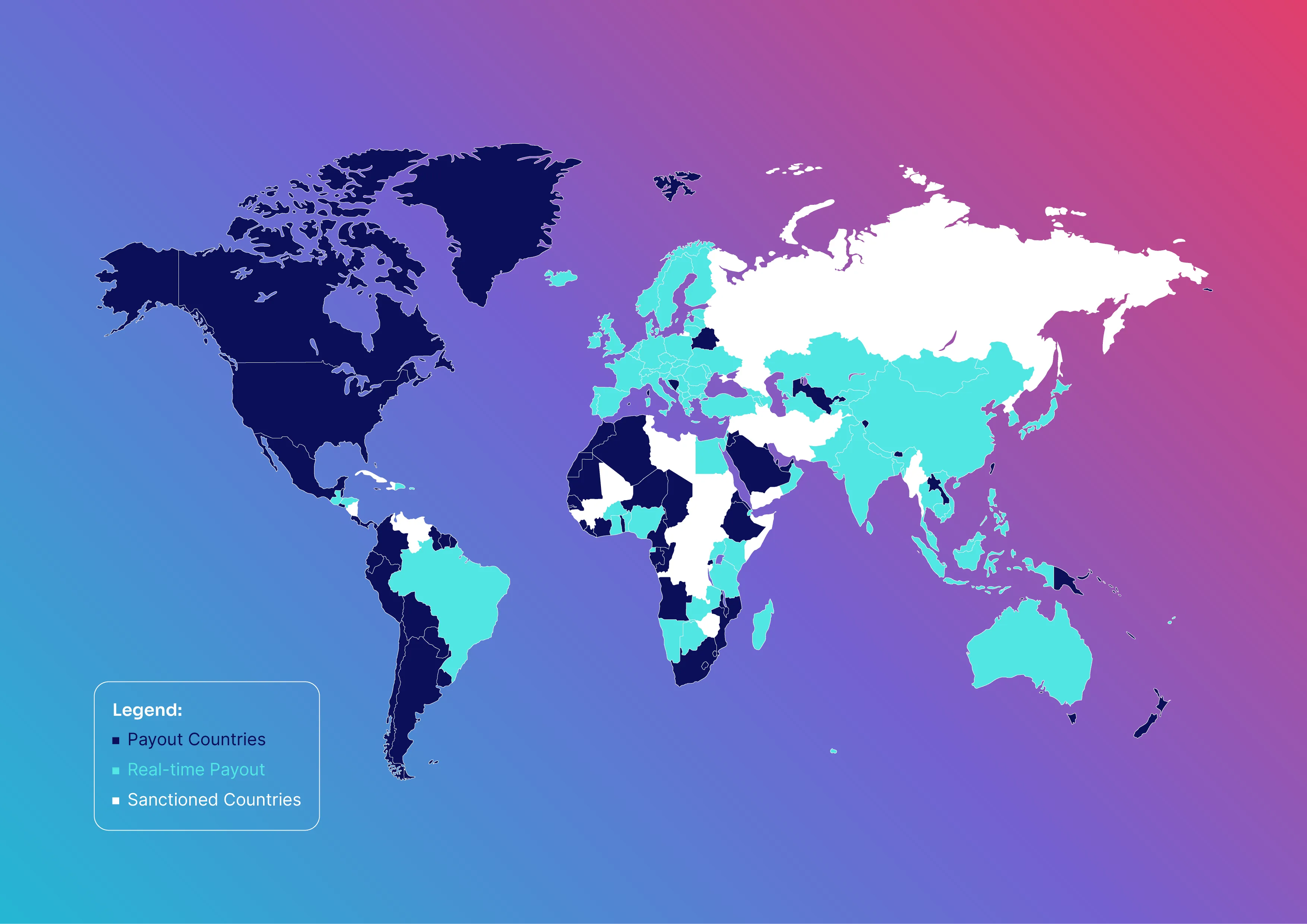

Despite global innovations, accessing the global al-time payment space is difficult for most businesses and financial institutions to do on their own.

Final Thoughts

For a truly localized payment solution, it is necessary to enable real-time transactions in different currencies through local and international payment networks. Additionally, it is important to ensure compliance with local regulations and offer access to competitive foreign exchange rates. Although achieving this independently can be challenging for many, it is crucial to identify the right B2B payments partner, such as Nium, who has the essential infrastructure, payment networks, and established relationships to meet the requirements of modern global enterprises.

To learn more, connect with one of our payment experts today and find out how Nium can aid your business or financial institution access the world’s real-time payment networks.

.png@webp)

.png@webp)