Editor’s Note: Welcome to a new Nium blog series called Tech@Nium, our technology leaders will provide an inside look into new solutions for the most complex Money Movement challenges.

By Ankit Gupta, Chief Architect, Nium

Modern-day enterprise banking and payment systems are inherently complex - a complicated web of interconnected systems and legacy applications. Evolving market trends and ever-changing customer expectations are driving a trend towards payments infrastructure modernization, where much of the goal is to better integrate systems and applications to drive greater simplicity.

Complexity Drives Unpredictable Payments

Only when payment systems and applications are integrated and communicate effectively with each other can they achieve beneficial synergies. These synergies can enable the organization to meet new business goals, unlock new revenue streams, and maximize customer value. Let’s face it. Cross-border payments can be a convoluted and time-consuming process due to several factors: incomplete payment information; multiple intermediaries and correspondent banks; compliance, anti-money laundering (AML) requirements; and, other fraud-related use cases. We at Nium can speak firsthand on this since our platform has been instrumental in processing $20B+ transaction volume in 100+ real-time markets across the globe.

Moving money across multiple markets means crossing different clearing systems - many of which are not real-time and have specific cut-offs and clearing cycles. There are markets where payments cannot be made over weekends or public holidays. In real-time markets, whether a payment will go through real-time rails or conventional processing, depends on multiple factors, such as amount, purpose of payment and many others. If that was not complex enough, there can be additional delays due to compliance and risk, factors which can sometimes throw up false positives during transaction screening, risk, and AML checks. All of this adds to less transparency, high costs and slower straight-through processing rates (STP).

Payment Transparency and Predictable Processing

At Nium, we were determined to reduce the uncertainty of payment speed by offering accurate predictions, backed by service level agreements (SLAs) on processing times for payments as they go through distinct stages. Further, we wanted to alert customers anytime the payment deviated from the standard path. We proactively keep the customer informed about “Where is your payment,” rather than the customer getting frustrated and wondering what happened to my money? Payment Chronometer drew its inspiration from a marine chronometer which helps with precise navigation in high seas. Our payment chronometer helps our customers effectively sail through the difficult cross-border payment high seas!

Payment chronometer at Nium is used in the below customer journeys:

-

Internal Nium Tracking – Compliance/Payment Operations

-

End Customer tracking (Coming Soon)

How it Works: Internal Nium Tracking - Compliance/Payment Operations

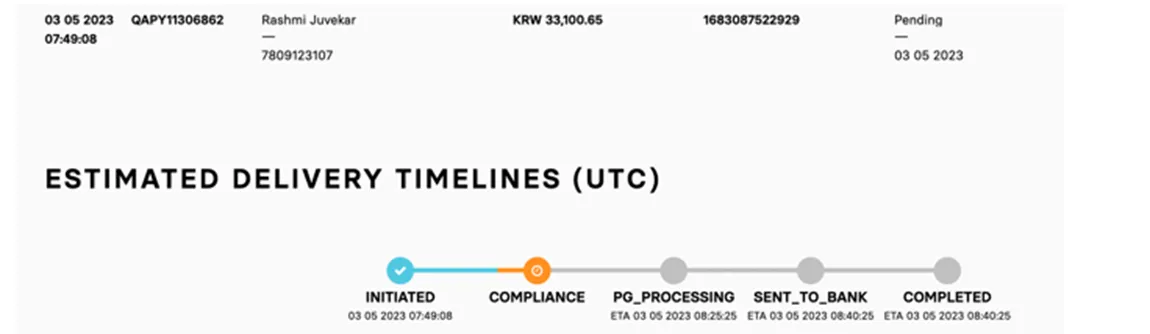

We track against the payment timeline that we promised to the customer since sometimes things can go wrong. Our internal operations and compliance teams vigilantly monitor internal dashboards where the estimated timeline for each payment stage is stamped and then completion of that stage is tracked against the expected timeline. We have alerts that go off when stage thresholds are breached and these alerts drive immediate attention from our teams.

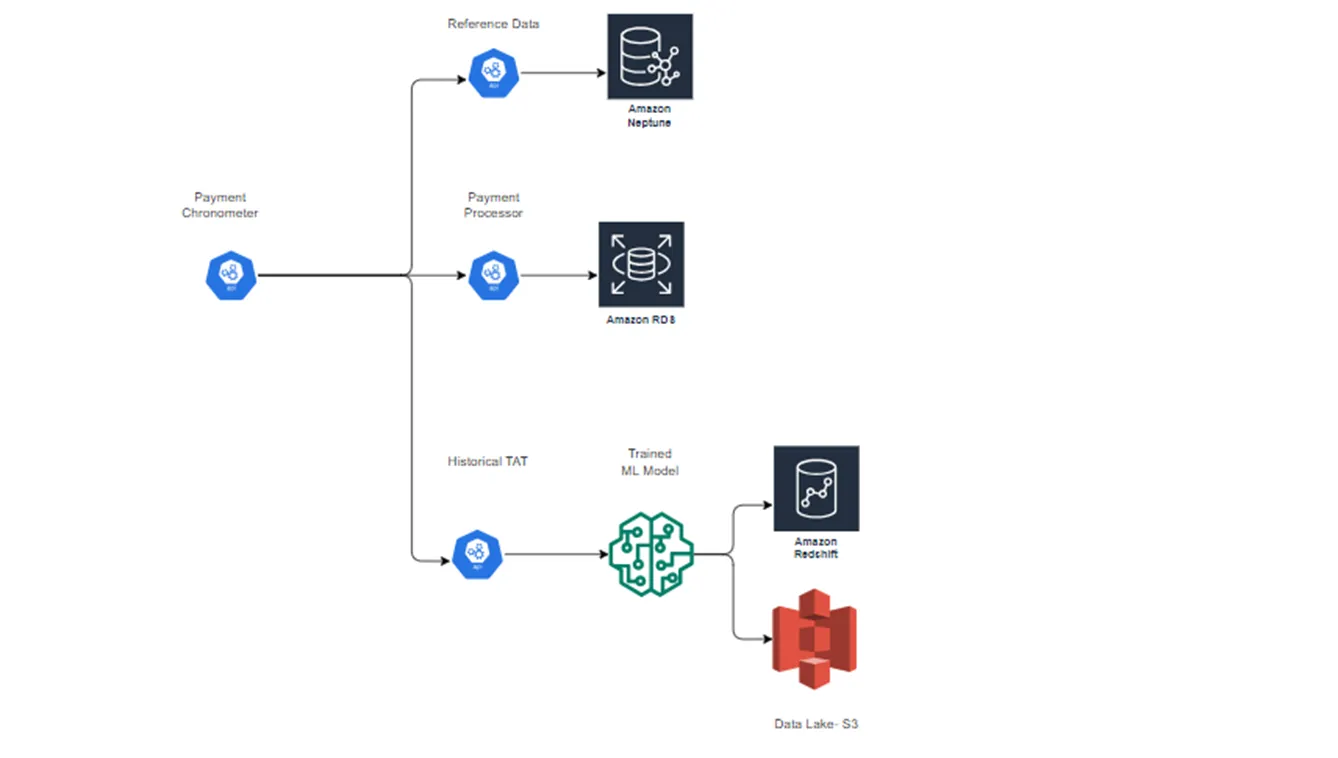

So, this covers the why of what we do and now let’s dive deeper into the technical architecture to understand how we make this happen 😊. Payment Chronometer is powered by the combination of our data platform and API-centric technology that we have built around it, coupled with the deep knowledge and experience we have with cross-border payments and its complexities.

When chronometer receives a request to give a Turnaround time (TAT) for a payment transaction it executes the below orchestration flow:

a) Chronometer will execute payment routing rules, which Nium maintains in its payment processor, to pick the optimal partner based on market, time, and cost efficiencies. Yes, we have over 60 + partners to ensure we have redundancies to failover in case of any partner issues in different markets.

b) Once the partner has been selected, the Chronometer lookups Reference data for that partner which is stored in a graph database- AWS Neptune. Neptune houses all our payment reference data, like holiday calendars, payment modes, clearing times etc. More on this architecture in a separate blog post 😊.

c) Chronometer also queries our Machine Learning (ML) model, which is built on top of our data lake. We look at patterns from the historical data using the ML model to come back with a prediction. This prediction response for the current transaction comes along with a degree of confidence basis historic transaction data. The ML model we have built uses similarity quotient and a combination of clustering algorithms and decision trees for running predictions.

d) Chronometer orchestrates and picks the turnaround time (TAT) for a transaction basis the response from reference data and historical TAT API. If the degree of confidence is above a specific threshold, chronometer will give more weightage to historic TAT else it will provide the TAT from reference data.

e) We track actual delivery times against the prediction we have provided to continuously improve and ideate on making the model more efficient.

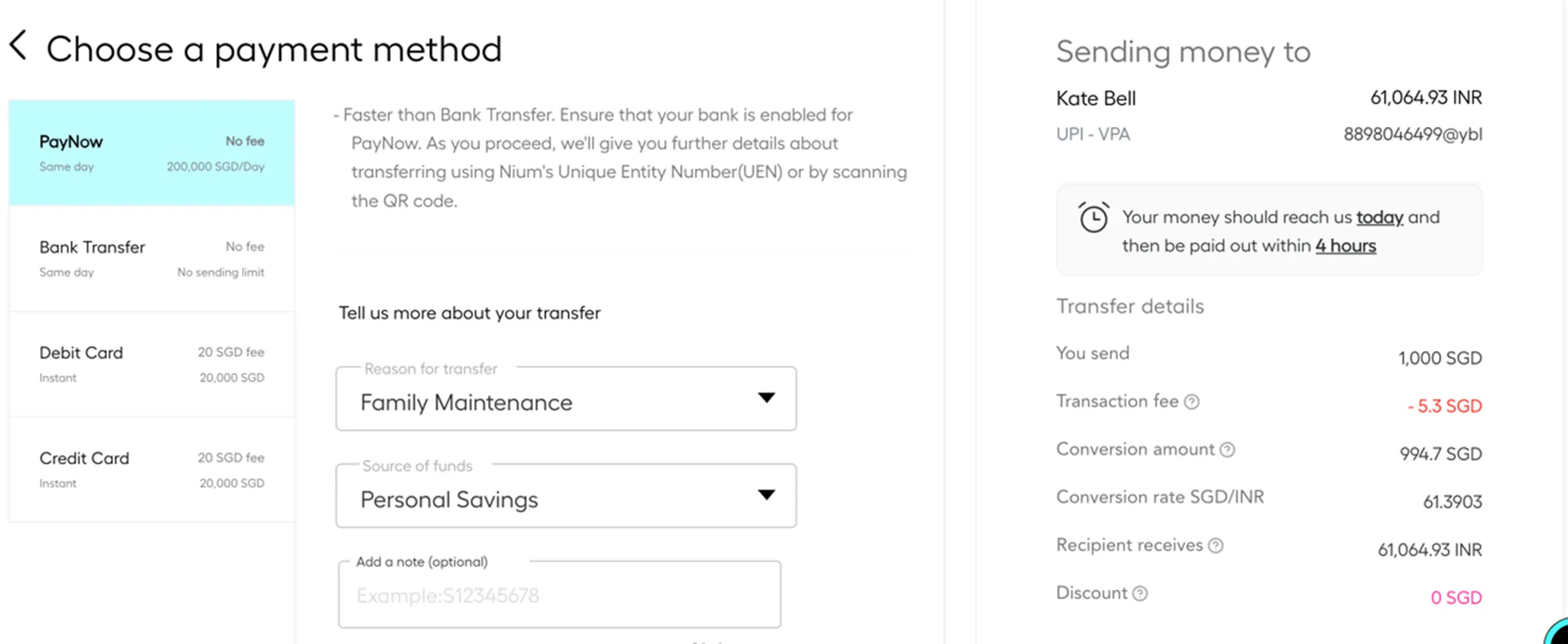

End Customer Tracking

When the customer is booking a transaction, in the below scenario from SGD to INR, based on the payment information provided, we can accurately produce a timeline for when we expect the payment to get completed within 4 hours. This estimation is done based on the destination country i.e., India in this case, amount, and payment mode. At Nium, we maintain and track all payment data across 100+ markets for us to successfully run this prediction. This gives our customers more transparency and visibility into payment processing times. We keep notifying the customer in the event the transaction processing time is longer than expected.

This is one of the many ways in which Nium tech is innovating to help navigate the difficult payment high seas for our customers. Stay tuned to see how we solve complex payment problems using innovative tech and business solutions!

.png@webp)