Platforms and companies operating globally are faced with a highly volatile FX (foreign exchange) market, and most solutions aimed at addressing this risk have highly opaque costs. Nium is solving this by offering guaranteed FX rates while providing full transparency into the FX costs, so clients always know what to expect. To further this promise, we’ve launched an FX markup calculator that shows the interbank FX rates (including historical data) so that you can calculate the true cost of FX from other providers and reveal the hidden markups and fees.

Why it’s hard

For companies that operate globally, moving money across borders efficiently and at a low cost is critical for their success. However, any cross-border payment involves a conversion from the currency of the sender to the currency of the beneficiary. The exchange rates between any two currencies fluctuate every minute based on hundreds of factors. Just to illustrate, look at the extent of FX rate fluctuations between the British Pound and Japanese Yen just within a few days.

In addition to the rate fluctuations, other factors like differences in regulatory environments, non-overlapping working hours/days, slow settlement speeds and insufficient liquidity add further complications. In this environment, sending a fixed amount to the beneficiary at a competitive cost is a bit like trying to land the ball on the other side of this crazy shifting ping pong table!

A lot of service providers offer guaranteed FX rates to help address this problem, but these rates have huge markups included and provide very little transparency to the users. It is estimated that the hard costs of FX average 6.5% to the bottom line and this true cost is never known upfront. No wonder 36%1 of SMEs lack visibility on how much money is lost in FX.

For any global enterprise paying overseas suppliers, paying employees, and reimbursing expenses, having a strategic approach to FX is imperative.

The Nium difference:

Guaranteed & competitive FX rates:

We understand the unique needs of customers based on their industry segment. For e.g., consider a payroll provider serving employers having international employees. The employer wants to ensure that its employees are paid the agreed amount in the destination currency exactly on the payroll date. It also wants to know the amount that it needs to pay in its source currency.

Nium offers a configurable “lock period” for its FX quotes to give the employer time to consider the rate and confirm the conversion. Once the conversion is confirmed at the guaranteed FX rate, Nium can execute it on a scheduled future date (to allow the source funds to arrive from the employer).

Our global network that consists of 60+ bank partners and licenses and $25+ Bn in annual funds flows, enables us to manage this risk at the lowest cost possible, thus allowing us to pass down the savings to our customers through competitive FX markups.

Let’s look at a few use cases:

-

A payroll platform that favors low FX costs over liquidity can lock in a favorable FX rate on the 10th of the month and schedule the conversion and settlement on the 12th to ensure they have the time to collect the source funds from the employers. This allows them to make the payroll payouts in the local currency on the 15th without having to worry about the FX rates and fluctuations on the payroll date. Real-time payouts to over 100 countries ensure businesses avoid bad employee experiences as well as potential penalties due to any late employee payments.

-

Another payroll platform that wants to fund “just in time” can lock an FX rate on the 13th, collect funds from the employer through a direct debit and make the employee payroll payments on the 15th using the real-time payout rails.

-

A financial institution can help a manufacturer lock in raw materials with a real-time FX payout to a supplier using existing funds in a Nium wallet, locking in critical supplies and facilitating a strategic supplier relationship.

Transparent markups:

We calculate the customer’s FX rate by adding a transparent markup (that we have previously agreed upon) to the latest interbank FX rate for that currency pair. All of our FX related APIs return this information (I.e., the interbank FX rate and the Nium markup), so that our customers can verify their actual FX markups anytime they want.

In contrast, some of our competitors use opaque FX rates without clearly showing the amount of markup they have added on top of the interbank rate. They also do not change their rates for days, which means that the markup between the underlying interbank rate and their rates is even more unclear.

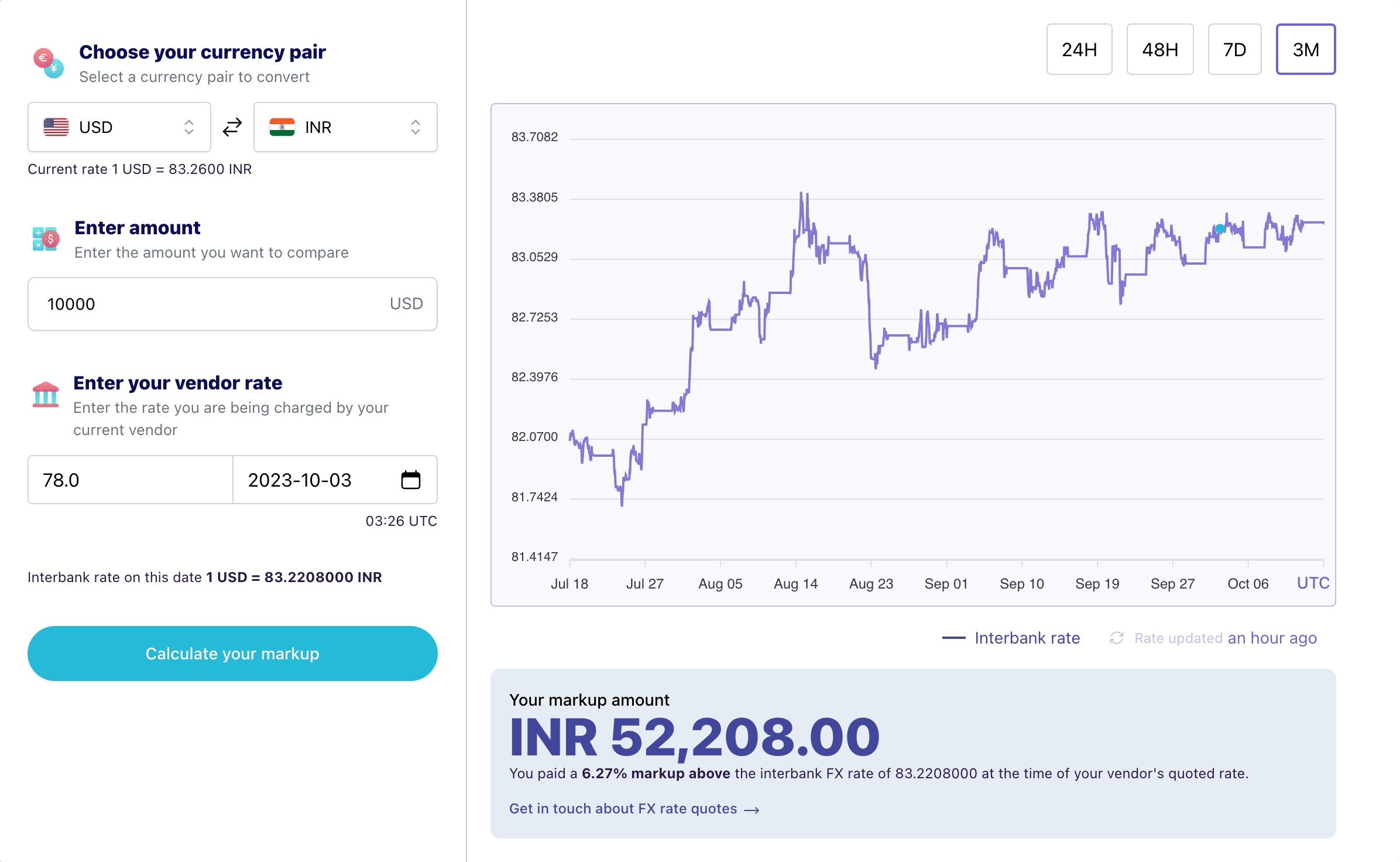

At Nium, we really want to move the industry towards providing more and more transparency, so that the end customers get the benefit of lower costs and an ability to make informed decisions. One of the tools we have built is an FX markup calculator that gives you access to the interbank FX rates (including historical data) so that you can calculate the true cost of FX from other providers and reveal the hidden markups and fees.

Try the Calculator: https://www.nium.com/platform/global-fx

Customer quote: ”We chose Nium for global payments in local currencies because of its ability to offer a complete, low value payments solution that has no limits and can be delivered real-time with 24x7 service. This is a major improvement over what legacy banks are currently offering. In 2023, payment volumes have steadily increased leading to significant cost savings. Client satisfaction due to real-time delivery has also increased in target verticals and markets around the world.” - Vince Carere, Director, Payment Solutions Integration and Implementation at Moneycorp

Learn more about Nium’s FX features and value proposition

Check out the FX API docs

Sources:

-

Mastercard business payments report.

By Sunil Joshi

.webp@webp)

.png@webp)

.png@webp)

.png@webp)